Ways to Give Smart

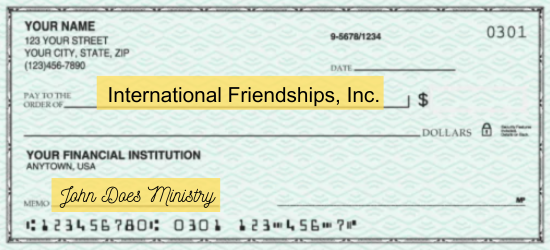

Make checks payable to “International Friendships, Inc.” and mail to:

International Friendships, Inc.

PO Box 933319

CLEVELAND OH 44193

Make sure to include instructions of how to direct your gift in the memo line. (See example below)

Did you know that thousands of companies match donations by their employees? Some companies may even match a retiree’s donation too!

Matching gifts allow us to extend life-changing hospitality and friendship to more international students out of reverence for Jesus. Learn if your employer has a matching gift program by clicking the button below!

Sharing a gift of appreciated stock or other property can be another way to “give smart” to IFI. Your advisor can guide you how to gain maximum tax benefits while also fulfilling your charitable gift plan as well.

Make sure to include instructions of how to direct your gift when you send it. You can also email us at to notify us of your upcoming gift and how it should be directed.

Donate your cryptocurrency gift at every.org

Make sure to include instructions of how to direct your gift in the “Add a note for International Friendships, Inc (IFI)” area.

Gifts through your Donor Advised funds can be a simple way to manage gifts to IFI, both in your lifetime and as part of your legacy estate plan. Let your Fund Advisor know of your selection of IFI for your giving. They will assist you to fulfill your intent.

When it comes to planning how best to share your estate, not all assets are created equal. Please consult your financial advisor or attorney to ensure you select the best option.

You may be looking for a way to make a big difference to help further our mission. If you are 70 1/2 or older you may also be interested in a way to lower the income and taxes from your IRA withdrawals. An IRA charitable rollover is a way you can help continue our work and benefit this year.

BENEFITS OF AN IRA CHARITABLE ROLLOVER*

- Avoid taxes on transfers of up to the IRS-allowed annual limit from your IRA directly to IFI

(This limit is indexed for inflation and may change each year – for 2025 it is $108,000) - Satisfy all or part of your required minimum distribution (RMD) for the year

- Reduce your taxable income, even if you do not itemize deductions

- Make a charitable gift that is not subject to standard charitable deduction limits

- Help further the mission and ministry of IFI by welcoming and discipling international students

Including a gift to IFI in your will or trust is the most common and often the simplest way to make a legacy gift. Through a bequest in your will or trust, you can leave a percentage of your estate, a specific amount of money or the remainder of your estate after your gifts to other loved ones. The back panel of this piece gives you generic legal language that your attorney can use in your documents. We can supply specific language at your request.

- RETIREMENT FUNDS: When it comes to passing down assets to successive generations of your family, not all assets are created equal. Some assets such as those held in an IRA, 401(k) or 403(b) would be considered income and are taxable to your heirs at their tax rate.

- LIFE INSURANCE POLICY: Gifts of life insurance can be a great way to leverage a little today into a lot tomorrow. Life insurance gifts often have lots of flexibility in the way they can be made. Listing IFI as your Beneficiary Designee can improve your overall estate tax position.